We insure a regional, retail food service company with over 50 locations throughout New England. This is a story of success through the application of sound risk management principles.

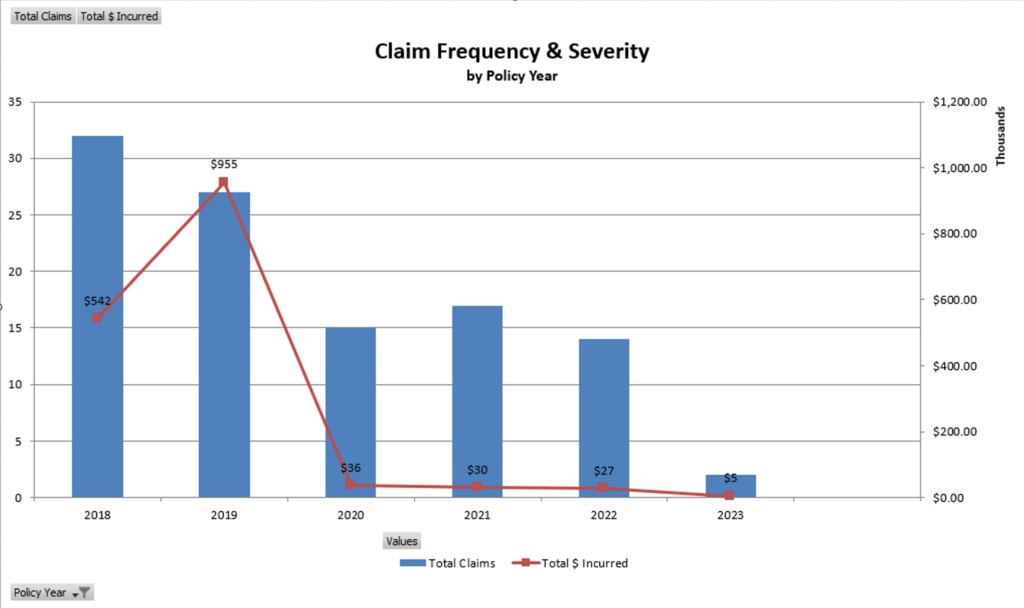

First a snapshot of their claim history. Notice that as the frequency (blue bars) fell from 32 to 2, their severity (red line) dropped from $995k to $5k. It is a well-founded risk management principle that as you impact frequency of claims, you limit the chances of fortuitous severe claims.

The Path to Success

Working with the CFO, who happens to be a huge fan of risk management, we assisted in the design, implementation, and feedback loop of the risk management plan.

We identified slip & fall accidents as the major driver of their loss history. Through root-cause analysis, it was determined that the most severe claims were in the tiled entry vestibules. The remedy: replace the tiled entry way to industrial carpet. That had an immediate, dramatic impact.

With loss control services provided by the insurance carrier (read that as free), they were able to analyze the coefficient of friction of the main dining area and choose the best tile and cleaning compounds to further limit the chance of falls.

Conclusion

As their insurance agent, I can tell you once management bought-in on the concept of risk management, we became an integral part of developing, planning, and implementation of their safety protocols.

Our responsibility as agents does not end in the procurement of insurance funding for claims. Our true value is when we impact a client’s claim history.

Victory